Intro¶

Here’s a simple example where we produce a set of plots, called a tear sheet, for a single stock.

Imports and Settings¶

[1]:

# silence warnings

import warnings

warnings.filterwarnings('ignore')

[2]:

import yfinance as yf

import pyfolio as pf

%matplotlib inline

Download daily stock prices using yfinance¶

Pyfolio expects tz-aware input set to UTC timezone.

You may have to import yfinance first by running:

pip install yfinance

[3]:

fb = yf.Ticker('FB')

history = fb.history('max')

history.index = history.index.tz_localize('utc')

[4]:

history.info()

<class 'pandas.core.frame.DataFrame'>

DatetimeIndex: 2243 entries, 2012-05-18 00:00:00+00:00 to 2021-04-19 00:00:00+00:00

Data columns (total 7 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 Open 2243 non-null float64

1 High 2243 non-null float64

2 Low 2243 non-null float64

3 Close 2243 non-null float64

4 Volume 2243 non-null int64

5 Dividends 2243 non-null int64

6 Stock Splits 2243 non-null int64

dtypes: float64(4), int64(3)

memory usage: 140.2 KB

[5]:

returns = history.Close.pct_change()

Create returns tear sheet¶

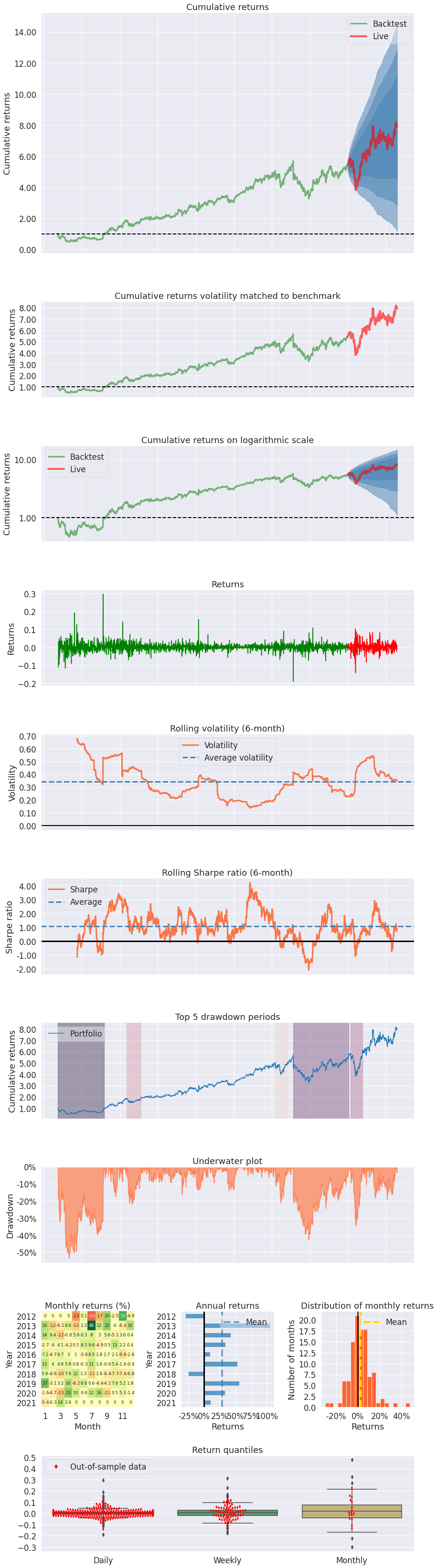

This will show charts and analysis about returns of the single stock.

[6]:

pf.create_returns_tear_sheet(returns, live_start_date='2020-1-1')

| Start date | 2012-05-18 | |||

|---|---|---|---|---|

| End date | 2021-04-19 | |||

| In-sample months | 91 | |||

| Out-of-sample months | 15 | |||

| In-sample | Out-of-sample | All | ||

| Annual return | 24.723% | 34.871% | 26.149% | |

| Cumulative returns | 436.882% | 47.255% | 690.583% | |

| Annual volatility | 36.174% | 43.171% | 37.263% | |

| Sharpe ratio | 0.79 | 0.91 | 0.81 | |

| Calmar ratio | 0.46 | 1.01 | 0.49 | |

| Stability | 0.88 | 0.64 | 0.89 | |

| Max drawdown | -53.623% | -34.592% | -53.623% | |

| Omega ratio | 1.17 | 1.17 | 1.17 | |

| Sortino ratio | 1.21 | 1.33 | 1.23 | |

| Skew | NaN | -0.19 | NaN | |

| Kurtosis | NaN | 3.52 | NaN | |

| Tail ratio | 1.07 | 1.08 | 1.05 | |

| Daily value at risk | -4.444% | -5.283% | -4.575% | |

| Worst drawdown periods | Net drawdown in % | Peak date | Valley date | Recovery date | Duration |

|---|---|---|---|---|---|

| 0 | 53.62 | 2012-05-18 | 2012-09-04 | 2013-08-05 | 317 |

| 1 | 42.96 | 2018-07-25 | 2018-12-24 | 2020-01-09 | 382 |

| 2 | 34.59 | 2020-01-29 | 2020-03-16 | 2020-05-20 | 81 |

| 3 | 22.06 | 2014-03-10 | 2014-04-28 | 2014-07-24 | 99 |

| 4 | 21.17 | 2018-02-01 | 2018-03-27 | 2018-06-01 | 87 |

[ ]: