Sector Analysis

To generate sector allocation plots in the positions tearsheet and PnL by sector in the round trips tearsheet, you must pass pyfolio a dictionary (or dict-like data structure) of symbol-sector mappings, where symbols are keys and sectors are values. create_full_tearsheet will also take symbol-sector mappings as the keyword argument sector_mappings.

In this notebook, we generate the positions tear sheet and round-trip tear sheet with sector mappings.

Load data

We use some test data for illustration:

|

AMD |

CERN |

COST |

DELL |

GPS |

INTC |

MMM |

cash |

| index |

|

|

|

|

|

|

|

|

| 2004-01-09 00:00:00+00:00 |

6961.92 |

21017.07875 |

7282.266152 |

21264.55188 |

7091.080020 |

21259.333890 |

21316.129606 |

-6192.360298 |

| 2004-01-12 00:00:00+00:00 |

18198.58 |

18071.25000 |

17675.836401 |

10804.31924 |

10685.411865 |

17872.477480 |

10882.026400 |

-3329.289887 |

| 2004-01-13 00:00:00+00:00 |

12060.86 |

11942.24625 |

12838.477446 |

16078.90380 |

16272.139000 |

12465.392511 |

12579.135758 |

4708.039735 |

| 2004-01-14 00:00:00+00:00 |

13102.40 |

15534.28125 |

14447.422640 |

15414.45080 |

15666.440185 |

14884.069620 |

13454.542620 |

-2749.470030 |

| 2004-01-15 00:00:00+00:00 |

15518.40 |

14547.05000 |

14164.039680 |

14407.48813 |

14926.122619 |

14422.385864 |

13929.159049 |

-2462.919316 |

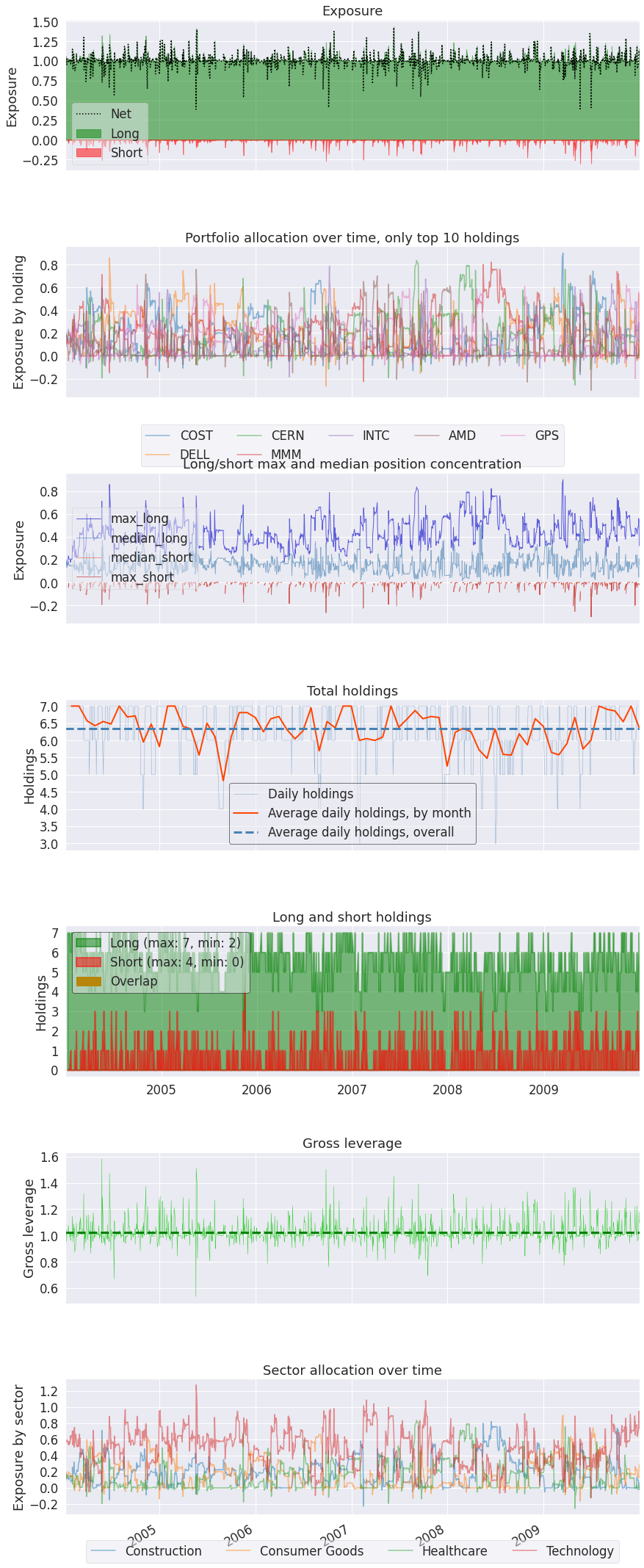

Run Position Tear Sheet

| Top 10 long positions of all time |

max |

| COST |

90.01% |

| DELL |

85.73% |

| CERN |

83.53% |

| MMM |

82.09% |

| INTC |

78.59% |

| AMD |

75.76% |

| GPS |

62.24% |

| Top 10 short positions of all time |

max |

| AMD |

-30.12% |

| DELL |

-26.58% |

| CERN |

-25.51% |

| MMM |

-22.62% |

| GPS |

-20.09% |

| INTC |

-18.47% |

| COST |

-16.44% |

| Top 10 positions of all time |

max |

| COST |

90.01% |

| DELL |

85.73% |

| CERN |

83.53% |

| MMM |

82.09% |

| INTC |

78.59% |

| AMD |

75.76% |

| GPS |

62.24% |

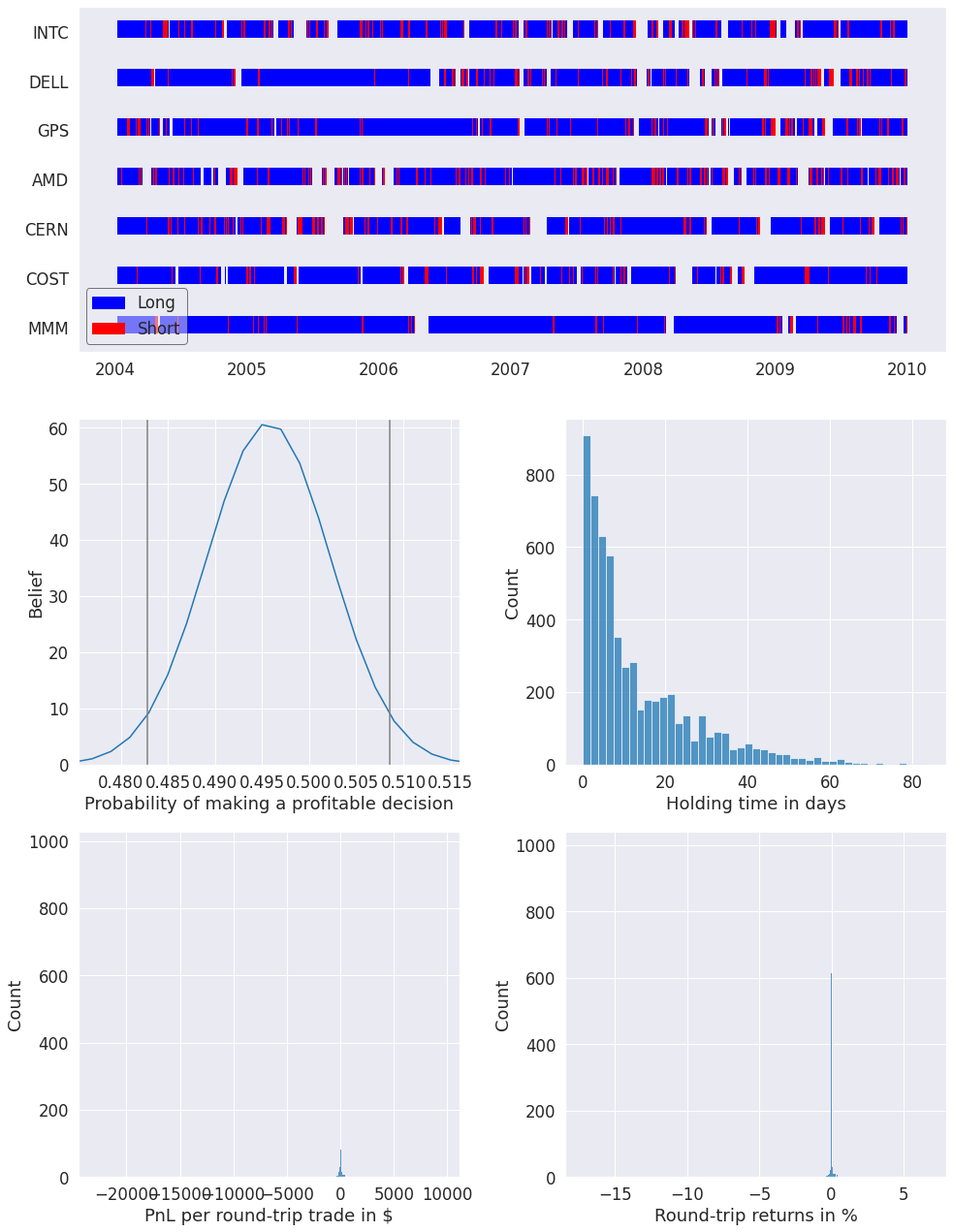

| Summary stats |

All trades |

Short trades |

Long trades |

| Total number of round_trips |

5822.00 |

1155.00 |

4667.00 |

| Percent profitable |

0.50 |

0.52 |

0.49 |

| Winning round_trips |

2886.00 |

595.00 |

2291.00 |

| Losing round_trips |

2917.00 |

553.00 |

2364.00 |

| Even round_trips |

19.00 |

7.00 |

12.00 |

| PnL stats |

All trades |

Short trades |

Long trades |

| Total profit |

$65404.25 |

$3560.10 |

$61844.15 |

| Gross profit |

$448803.34 |

$20608.45 |

$428194.89 |

| Gross loss |

$-383399.09 |

$-17048.35 |

$-366350.75 |

| Profit factor |

$1.17 |

$1.21 |

$1.17 |

| Avg. trade net profit |

$11.23 |

$3.08 |

$13.25 |

| Avg. winning trade |

$155.51 |

$34.64 |

$186.90 |

| Avg. losing trade |

$-131.44 |

$-30.83 |

$-154.97 |

| Ratio Avg. Win:Avg. Loss |

$1.18 |

$1.12 |

$1.21 |

| Largest winning trade |

$9500.14 |

$1623.24 |

$9500.14 |

| Largest losing trade |

$-22902.83 |

$-661.29 |

$-22902.83 |

| Duration stats |

All trades |

Short trades |

Long trades |

| Avg duration |

13 days 03:21:49.653555479 |

2 days 10:39:35.064935064 |

15 days 18:53:36.628026569 |

| Median duration |

8 days 00:00:00 |

2 days 00:00:00 |

12 days 00:00:00 |

| Longest duration |

84 days 00:00:00 |

13 days 00:00:00 |

84 days 00:00:00 |

| Shortest duration |

0 days 00:00:01 |

1 days 00:00:00 |

0 days 00:00:01 |

| Return stats |

All trades |

Short trades |

Long trades |

| Avg returns all round_trips |

0.01% |

0.01% |

0.01% |

| Avg returns winning |

0.13% |

0.13% |

0.12% |

| Avg returns losing |

-0.11% |

-0.12% |

-0.11% |

| Median returns all round_trips |

-0.00% |

0.00% |

-0.00% |

| Median returns winning |

0.02% |

0.02% |

0.02% |

| Median returns losing |

-0.01% |

-0.01% |

-0.01% |

| Largest winning trade |

6.78% |

6.78% |

6.19% |

| Largest losing trade |

-17.23% |

-3.95% |

-17.23% |

| Symbol stats |

AMD |

CERN |

COST |

DELL |

GPS |

INTC |

MMM |

| Avg returns all round_trips |

0.04% |

-0.01% |

-0.02% |

0.02% |

-0.02% |

-0.04% |

0.07% |

| Avg returns winning |

0.13% |

0.08% |

0.09% |

0.12% |

0.12% |

0.17% |

0.16% |

| Avg returns losing |

-0.07% |

-0.08% |

-0.10% |

-0.08% |

-0.18% |

-0.21% |

-0.05% |

| Median returns all round_trips |

0.00% |

-0.00% |

-0.00% |

0.00% |

0.00% |

-0.00% |

0.00% |

| Median returns winning |

0.02% |

0.02% |

0.02% |

0.02% |

0.02% |

0.02% |

0.03% |

| Median returns losing |

-0.01% |

-0.01% |

-0.01% |

-0.01% |

-0.02% |

-0.03% |

-0.01% |

| Largest winning trade |

6.78% |

1.69% |

1.48% |

3.29% |

2.72% |

5.01% |

6.14% |

| Largest losing trade |

-1.59% |

-6.39% |

-4.48% |

-3.28% |

-17.23% |

-6.86% |

-1.60% |

| Profitability (PnL / PnL total) per name |

|

| symbol |

|

| COST |

39.90% |

| INTC |

38.27% |

| CERN |

32.31% |

| MMM |

22.15% |

| GPS |

4.94% |

| AMD |

-6.41% |

| DELL |

-31.15% |

| Profitability (PnL / PnL total) per name |

|

| symbol |

|

| Consumer Goods |

39.90% |

| Healthcare |

32.31% |

| Construction |

22.15% |

| Technology |

5.65% |